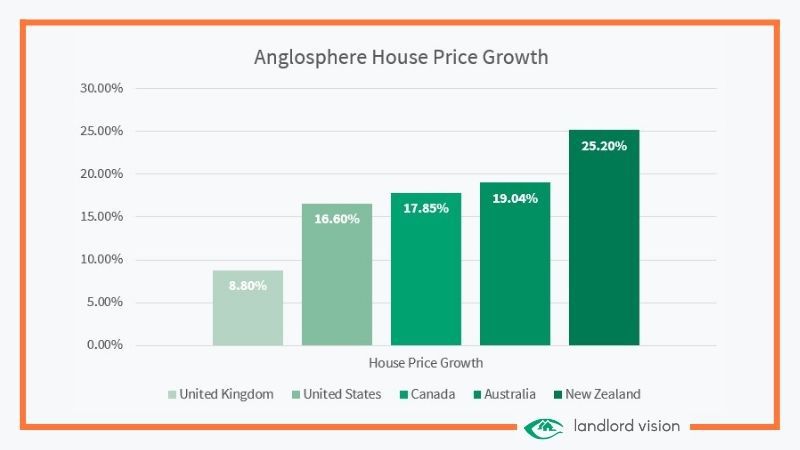

It has been a stellar year for UK property owners, with house prices rising over 8.8% in the 12-months to June. However, we are not alone in experiencing a year of unprecedented house price growth. In fact, it could be said that house price growth has been relatively sedate when compared against the rest of the Anglosphere.

Throughout the Anglosphere, house prices have increased at an eye watering rate. House prices in the United States (US) have risen by 16.6% in the year to May, according to the S&P National Home Price Index. North of the United States, the average house price in Canada rose by 17.9% in the year to June. In Australia, median house prices are up a similar 19.0% in the year to July, whilst New Zealand has seen prices rise by 25.2% in the same period.

Please note that there are some variations in the manner in which different international indices are compiled and the time period in which they measure.

International housing markets provide an interesting point of comparison for landlords and property investors, many of which tend to only consider house prices relative to a domestic market. Viewed against fellow Anglosphere countries, house price performance in the UK appears relatively conservative – even relatively sustainable.

Learning From United States House Prices

International house prices provide more than just a point of reference for landlords and property investors. Studying international markets can help investors to better understand the themes and trends driving the UK’s own property market.

Take the United States, where house price growth has been double that of the UK. Similar to our own market, house price growth has been driven by an extraordinary combination of mountainous personal savings and ultra-low interest rates. Investors and homeowners alike have more cash savings and can borrow more, fuelling their ability to fund higher property prices. The direct nature of US government spending has only intensified this trend. Many Americans received stimulus cheques directly from the government, irrespective of the impact Coronavirus had upon them, further bolstering the cash savings of many households.

Much like the UK, the United States has experienced chronic underinvestment in the supply of new houses. Countless regions have a woefully insufficient housing stock, forcing buyers to compete for a limited array of properties and bid up prices. Those houses which have been developed, tend to be focused in city-centre areas, compromising on space in exchange for a premium location. Concentrating the supply of new properties in only a few subsections of the market has helped to inflame the price of spacious regional properties, where supply is most lacking.

What Does This Tell Us About The UK?

As easy as it is to forget, the property market in the UK does not operate in isolation. All across the world, similar housing markets are experiencing similar trends. These markets will operate on their own property cycles and will be at their own unique stages of maturity, some of which will be more advanced than that of the UK. By keeping an eye on these markets, UK investors can stay up to date with more general housing themes and legislative trends.

Already, in runaway markets like Australia and New Zealand, governments have been forced to step into control house prices. New legislation has removed interest rate deductibility for investors and restricted the supply of credit by tightening lending criteria. This has helped to dampen growth in recent months and restrain the more speculative end of the market.

Despite a recent spate of hostile legislation aimed towards landlords, the UK government remains broadly supportive of the overall housing market. However, should property prices continue their upward trajectory, the government may seek to imitate the actions of their counterparts in Australia and New Zealand. Additionally, it will be interesting to assess how other economies respond to a cooling of their housing markets, to see whether this causes prices to reverse and unwind some of their Coronavirus related growth or whether prices merely pause for breath.

References

CoreLogic, 2021. Home Property Value Index – Monthly Indices. [Online]

Available at: https://www.corelogic.com.au/research/monthly-indices

[Accessed 20 August 2021].

Real Estate Institute of New Zealand, 2021. Monthly House Price Index Report. [Online]

Available at: https://www.reinz.co.nz/Media/Default/Statistic%20Documents/2021/Residential/July/REINZ%20Monthly%20HPI%20Report%20-%20July%202021.pdf

[Accessed 20 August 2021].

S&P Dow Jones Indices, 2021. S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index. [Online]

Available at: https://www.spglobal.com/spdji/en/indices/indicators/sp-corelogic-case-shiller-us-national-home-price-nsa-index/#overview

[Accessed 20 August 2021].

Teranet And National Bank of Canada, 2021. House Price Index: Price Growth Remains Strong, But Slows In July. [Online]

Available at: https://housepriceindex.ca/2021/08/july2021/

[Accessed 20 August 2021].

Disclaimer: This ‘Landlord Vision’ blog post is produced for general guidance only, and professional advice should be sought before any decision is made. Nothing in this post should be construed as the giving of advice. Individual circumstances can vary and therefore no responsibility can be accepted by the contributors or the publisher, Landlord Vision Ltd, for any action taken, or any decision made to refrain from action, by any readers of this post. All rights reserved. No part of this post may be reproduced or transmitted in any form or by any means. To the fullest extent permitted by law, the contributors and Landlord Vision do not accept liability for any direct, indirect, special, consequential or other losses or damages of whatsoever kind arising from using this post.