As a trader in property, the land or properties you buy for development and/or resale are your trading stock or work-in-progress. In this post, we look at how to make the most of your property development by learning the most tax efficient way to handle your trading stock.

At the end of each year, you include the cost of any stock you have not sold in your balance sheet, and it becomes your “opening stock” for your next year of trading. This means that you do not get a tax deduction for your trading stock until you sell it.

Case Study – Land or Property Bought as Trading Stock by a Property Developer

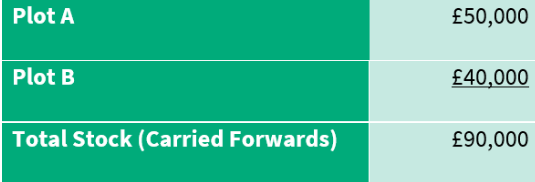

Letitia begins trading as a property developer. In her first year she buys two plots of land, Plot A and Plot B, for £10,000 each. At the end of the year, she has spent £40,000 on constructing a house on Plot A, and £30,000 on constructing a house on Plot B. She has not sold either house. Her “Closing Stock and Work-in-Progress” for Year 1 will be:

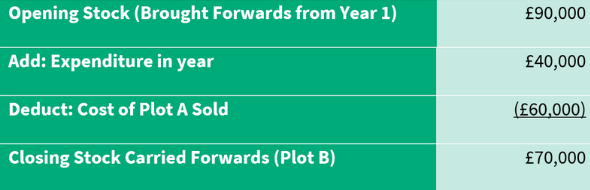

During Year 2, she spends another £10,000 on Plot A, finishing the house, which she sells for £100,000. She spends another £30,000 on Plot B, but does not sell it.

For Year 2, her stock will be:

The £60,000 expenditure on Plot A is taken from Stock and set against the £100,000 sale proceeds to arrive at the profit of £40,000 on that sale. Note that closing stock equates to the cost to date in Plot B, which has not yet been sold.

This is a simplified version of how trading stock works, but the important point is that the cost of your stock is carried forward until you sell it. If you are considering substantial property development projects – and particularly those that may take several accounting periods to complete – you should take expert advice on how closing stock, work-in-progress and “long term contracts” should be valued.

Note that “closing stock”, etc., is an accounting adjustment required when using traditional bases of accounting, not the simple “cash basis”. The majority of trading property developers will not want to adopt the cash basis, despite its vaunted simplicity, because the cash basis for traders permits only a measly £500 for annual finance costs. Note that for Buy-to-Let businesses, which are not trading businesses, there is no £500 ceiling for annual finance costs (although there are other constraints).

Property and Land Not Acquired as Trading Stock by Property Developers

In most cases, it will be clear that a property developer is trading – he or she buys bare land or a building, builds on the land or improves the building, and then sells it.

The situation is not so clear-cut if the land or building in question was not acquired as trading stock, such as where it was inherited, or where a buy to let investor decides to develop and sell a property he has owned and rented out for some time.

Case Study – Land Not Acquired as Trading Stock

Rebecca inherited a two-acre field from her aunt in 2001. It was valued at £70,000, as at the time there was no prospect of getting planning permission for it.

She used the field to graze her horse until 2021, when it became apparent that it might now be possible to get planning permission for four houses. The land becomes much more valuable – say £500,000.

- If Rebecca simply gets outline planning permission and sells the land, she will realise a capital gain – likely in this case to be £430,000, or potentially more, if she is able to sell with planning permission.

- If she sells the land to a developer on a “slice of the action” deal, she will make a capital gain, though she may have problems with the “Transactions in Land” regime.

- If she decides to do the development herself, hiring architects, builders, and so on to construct the houses, and sells them, the position is more complicated: is she trading, or merely enhancing a capital asset?

Thanks to the Transactions in Land approach, the most likely interpretation of the facts will be that at the point that she decided to go ahead with the development and to make a profit, she “appropriated” the land as trading stock.

If you “appropriate” a capital asset you own to trading stock, you are treated as if you had disposed of it for CGT purposes at its market value, and in your trading accounts you treat it as if you had bought it at the same value.

If you wish, you can elect to “hold over” the capital gain you make on the land by “appropriating” it, so that you do not pay CGT, but the whole profit (including the gain you have just elected to hold over) is taxed as trading profits when you sell it. It may be to your advantage not to do this, however, as CGT is charged at up to 28%, (for residential property), whereas your trading profits will be taxed at up to 45%, potentially plus NIC.

Essentially, Rebecca has a choice if she decides to develop her land herself: stand a 20% CGT charge on the notional capital gain when she disposes of her investment land to herself; (note that in this case the land has no dwelling on it so is taxable at only 20% maximum; albeit she may not have the funds to pay any tax – she hasn’t really sold anything); or, she can make the election to postpone the capital gain into the eventual sale of the development – potentially at (45% + 2% NICs) = 47% (but at least she will have some proceeds from selling the development to pay her tax bill!). The difference is likely to be based on that gain of £430,000 and whether it is taxable to CGT ‘early’ at 20%, or taxable later as trading income, at 45% or 47% (although the value may shift on achieving planning permission).

The election also used to be potentially beneficial in that, if Rebecca’s land had lost value prior to development, so she was looking at a capital loss, then she could make the election and effectively convert that into an Income Tax loss, by reducing her profits from the development. Unfortunately, the government has deemed this “unfair” to HMRC, so elections will now be permitted only when the land is standing at a gain (for appropriations on or after 8 March 2017).

Now, let’s consider a slightly different scenario.

Rebecca’s brother Tom inherited a rundown old house from another aunt. He decided to sell it immediately, but first he spent some money on refurbishing and improving it.

Whether Tom is trading or not is a more difficult question – arguably, he is not changing the nature of the asset he inherited (a house) but merely taking steps to get the best price for it. However, it could be argued that the “Transactions in Land” rules have again been triggered, if HMRC feels that he has “developed” the property.

Alternatively, he could formally “appropriate” the house to a new trade of property development.

Why would he want to do this? If he stuck with the capital gains route, he would have his annual exempt amount of £12,300 to deduct from the gain, whereas if he becomes a trader he will be liable to Income Tax on the profit, AND to NIC – at potentially a much higher overall rate.

There are two reasons why he might make the choice to trade:

- Certainty – the whole issue of when you start trading with property like this is a “grey area”, but if you deliberately “appropriate” the asset to trading stock, HMRC will find it very difficult to argue that you have not done this.

- Interest on loans – if Tom had to borrow money to pay for the improvements, he would not get relief for the interest he paid if the property were sold for a capital gain, whereas for a property developer, the interest would be allowable as a deduction from trading profits.

There is a third possible reason for this “appropriation” – it is sometimes better to trade as a property developer through a limited company, and “appropriating” an asset to trading stock can in some scenarios be the first stage in transferring it into a limited company.

Taking Trading Property Stock for Your Own Use – or to Let Out

In a way, this is the reverse of the previous case study. If you are trading as a property developer, and you decide you would like to keep one of the houses in your trading stock (either to live in it yourself, or to let it out for the long term), you will come up against the notoriously unfair rule derived from the tax case of Sharkey v Wernher, which says you are deemed to make a market value sale to yourself. So notoriously unfair, in fact, that it was at risk of serious challenge until it was turned into legislation – ITTOIA 2005 ss172A – F, by reason of FA 2008.

If you are a property developer, therefore, and you decide to take one of your houses in stock and keep it for yourself, whether to live in or to let out, your property development business will be taxed as if it had sold that house to you at its market value.

The moral of this is to make your mind up quickly – ideally before you build the house – so that you can take the land out of the business at its (presumably much lower) market value, and then all you have to do is exclude the cost of building that house from your property development business accounts. You should ensure to keep good evidence of when the decision was made to appropriate the property from trading stock to capital / personal use. There is no option to ‘postpone’ the trading profit on deemed sale to yourself, until you ultimately dispose of the asset, that corresponds with the option for taking capital assets from your business.