Conventional wisdom in the UK has always held that it is better to save up to buy your first property than to rent one. The logic being that purchasing a home gives aspirational families security and a stake in society. However, this logic fails to account for the many benefits of renting and the flexibility provided by the private rental sector.

Renting provides tenants with a flexibility to move and scale their living arrangements as their lives and livelihoods change. Not only do tenants avoid the potentially costly millstone of mandatory mortgage payments and high transaction fees, but currently it is likely that renting a property will be financially less costly per month than purchasing one.

The Cost of Renting Vs Buying

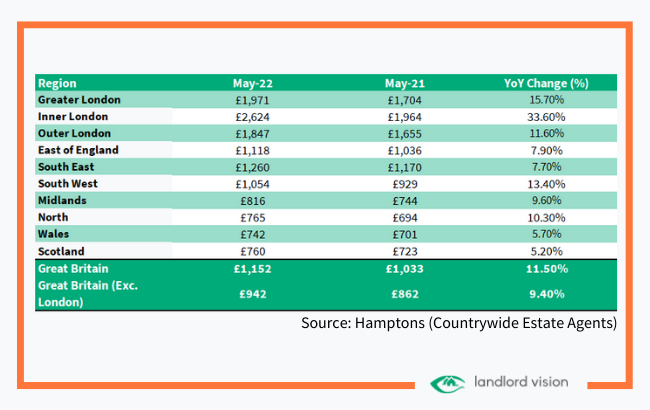

Research by the estate agents Hamptons, suggest that it has been financially cheaper to purchase a property than to rent one over the past 11 months. Rising rents and extremely competitive mortgage rates have meant that it is more affordable to service the average mortgage with a 10% deposit, than it would be the pay the average rent on a property. For example, in May, it was £40 per month cheaper to service a mortgage with a 10% deposit than it was to rent the same home, while in November 2021 it was £160 cheaper to buy than rent.

However, things are set to change. The Bank of England’s decision to raise the base rate will help to improve the relative affordability of renting. Assuming that the full 0.25% base rate increase is passed onto mortgage rates, renting a home will effectively be £1 cheaper per month than buying one. Rents would need to increase by 12.5% just to keep pace with the rising costs of servicing mortgages (compared to the realised 11.5% increase in May).

Not only is renting now a more affordable monthly option than buying, but the odds also suggest that we are set for further base rate rises in the near future. Such increases will only help to widen the divide between the cost of purchasing properties and the cost of renting them. Hamptons highlight that each 0.25% rise in the base rate will help to push the cost of buying further above the cost of renting by £41 per month for a typical first-time buyer with a 10% mortgage.

Regional Differences in The Cost of Renting Vs Buying

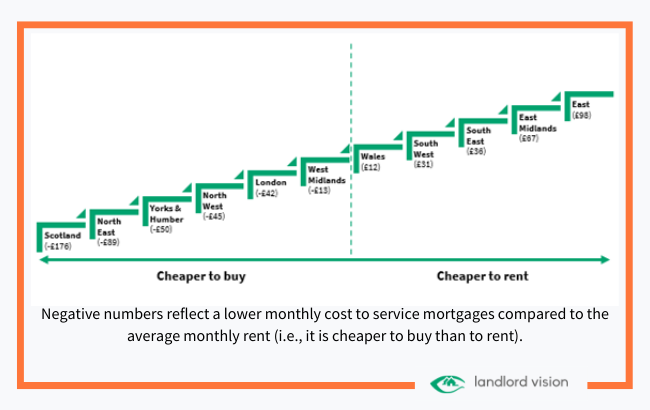

As has been commonly discussed on this blog, the UK’s housing market isn’t one homogenous blob. It is, in fact, an aggregation of hundreds of smaller independent housing markets which can operate on their own unique cycles. This is equally apparent when comparing whether it is more cost effective to rent or to buy a property. Should base rates rise to 1.25%, it will be cheaper on average to rent a property, than to buy one in; Wales, the South East, the South West, the East Midlands and the East. However, should rates rise to 1.5%, it will also be cheaper to rent on average in both the West Midlands and London.

Currently, Scotland is the most affordable region to service monthly mortgage rates than rent, by some way. On average, homeowners will save £176 per month compared to the average rent on a property, a remarkable £2,112 per annum. In comparison, the East is the most relatively affordable location to rent properties as opposed to buying them. The average tenant in the East pays £98 less per month on their rent than a comparable homeowner.

Disclaimer: This Landlord Vision blog post is produced for general guidance only, and professional advice should be sought before any decision is made. Nothing in this post should be construed as the giving of advice. Individual circumstances can vary and therefore no responsibility can be accepted by the contributors or the publisher, Landlord Vision Ltd, for any action taken, or any decision made to refrain from action, by any readers of this post. The opinions reflected in this post are not necessarily opinions held by Landlord Vision. All rights reserved. No part of this post may be reproduced or transmitted in any form or by any means. To the fullest extent permitted by law, the contributors and Landlord Vision do not accept liability for any direct, indirect, special, consequential or other losses or damages of whatsoever kind arising from using this post.