Lettings relief is a valuable relief currently available to landlords who at some time have lived in the property they are selling as their only or main residence and for which an amount of principal private residence relief (PPR) is available. Here we’ll explain what it is and how it’s changing.

CGT Lettings relief – the impact of changes as from 2020

The relief reduces the amount of the capital gains charged. As of April 2020, the relief will only be available to landlords who either share their home with a tenant or who have never occupied the property. The intention is to discourage landlords from “flipping” properties to avoid paying CGT but it will be the ‘accidental’ landlords who will be most affected i.e. those who have been unable to sell and decided to let instead. The Government intends to consult on the details.

The relief is still available for another year but with the impact of the Mortgage Interest relief restrictions many landlords are selling to take advantage of the relief whilst still available. For those landlords and those not affected letting relief applies where:

- a gain is incurred on a property where PPR is available;

- part or all of the property has at some time been let as residential accommodation; and

- a chargeable gain arises relevant to the letting period

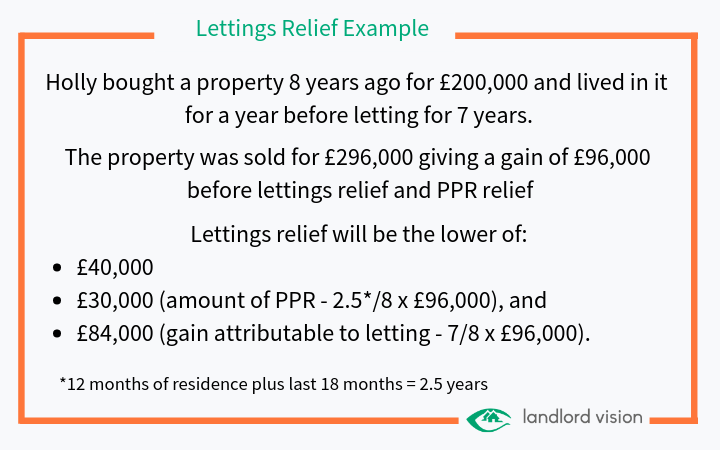

The exemption is restricted to the lower of £40,000, the amount attributable to the period for which the property was let and the amount equal to the exempt gain on the PPR proportion. The relief is per person therefore a property owned jointly attracts a maximum of £80,000 relief. The reduced amount does not cover any proportion of the chargeable gain made when the property has been empty.

Note: PPR relief is extended for 18 months to cover the last period of ownership (36 months for owners who move into a care home or who are disabled). However, the Government is proposing to cut that to nine months (retaining the 36-month exemption period for disabled owners or those who live in residential care).

HMRC Helpsheet HS: Private Residence Relief (2018) section 5

Taxation of Chargeable Gains Act 1992 s222 and s223