Throughout 2021, Landlord Vision has continued to cement its place as the UK’s foremost property management software for landlords. With a burgeoning user base and over 38,000 tenancies managed in the software up and down the country, we are well placed to understand and serve the UK’s private rental market. With this in mind, we have compiled the results from our annual Landlord Survey, to better understand and support the nation’s landlords.

The survey has purposefully sought to canvass the views of landlords across a range of topics, be it their use of professional services, reliance on third-party organisations, or the effect of Covid-19 on their portfolios. Unsurprisingly, given the harsh regulatory environment and pandemic-related headwinds, landlords continue to harbour worries about the future of the market. Many landlords worry about the effects of future legislative changes and rising borrowing and maintenance costs. Yet, despite this, the majority of landlords continue to see property investment as a lifelong pursuit.

The Biggest Concerns for Landlords

Putting aside the ‘C’ word (Covid-19) for the moment, landlords were asked to elaborate on their biggest concerns. Unsurprisingly, many landlords highlighted concerns relating to tenants (26%), rising costs (10%), and maintenance (9%). Yet, by far the most prolific response was the concern over changing legislation in the private rental market, with 40% of respondents highlighting this as their biggest concern. The remaining 15% of respondents highlighted concerns relating to property prices, the rental market, or finance – with a fortunate 4% suggesting that they had no immediate concerns.

The Biggest Legislative Concerns for Landlords

Two-fifths of all respondents to the Landlord Vision Survey 2021 highlighted the changing legislative environment as their biggest concern for their property business. The private rental sector has witnessed a decade of increasing regulatory pressures, ranging from minimum EPC requirements through to mandatory electrical installation condition reports (EICR’s). Evidently, many landlords fear that the trend towards increased legislation will continue into the 2020s. Of the landlords that highlighted changes to legislation as their biggest concern, nearly half indicated the risk of increased taxes on landlords (44%). A third of respondents highlighted changes to environmental rules (18%) and eviction rules (18%), with many concerned about the potential effects of requiring properties to meet a minimum EPC rating of C and changes to the issuance of Section 21 notices.

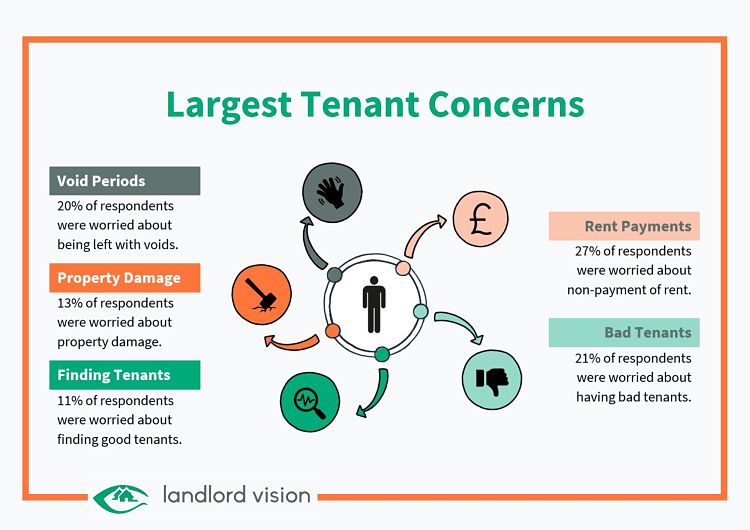

The Biggest Landlord Concerns Regarding Tenants

Over a quarter of landlords listed tenants as their biggest concern. Of the 26% of respondents that selected this option as their key concern, most listed worries relating to the non-payment of rent (27%), bad tenants (21%), and the potential for void periods (20%). Many of the concerns are typical to those you might expect from a survey of landlords, with the quality and behaviour of tenants attracting the most focus. One in ten respondents were concerned that they would not be able to find tenants for their properties, with a sizeable number concerned about the prospect of tenants causing damage (13%). Only 8% of respondents expressed concerns relating to property arrears – although when viewed alongside ‘non-payment of rents’ this could be considered to be one of the largest subcategories.

Other Landlord Concerns

Nearly a fifth of landlords suggested that either rising costs (10%) or maintenance issues (9%) were their biggest concerns. Although many that selected rising costs as a key concern did not elaborate further, those that did provide more detail were almost entirely concerned about the prospect of rising mortgage rates. With interest rates currently at historic lows, it seems highly likely that rates can only rise from here on in. Otherwise, landlords expressed concerns relating to costs associated with complying with legislation, such as meeting EPC requirements and arranging EICR’s for their properties. With regards to property maintenance, many landlords highlighted difficulties in finding contractors to carry out works and inflation in the costs of carrying such work out.

The Landlord Vision Landlord

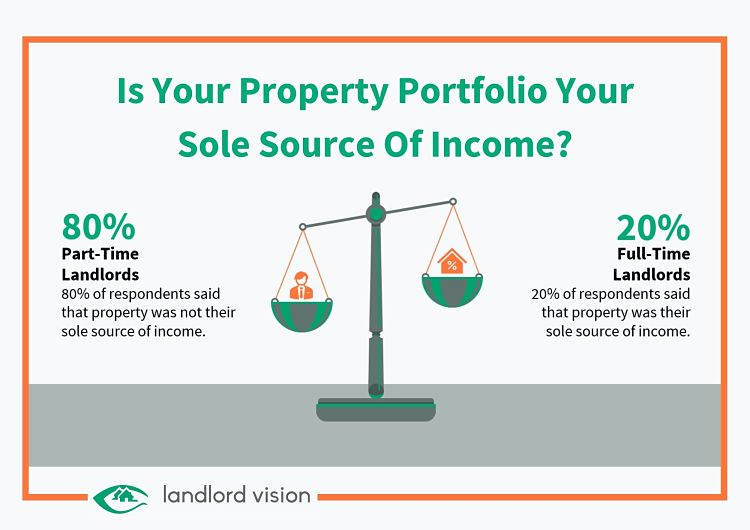

What Percentage of Landlords Run Their Property Business Full-time?

Whilst the sheer variation and scope of property investment make it hard to profile a ‘typical’ landlord, the Landlord Vision Survey sought to find out more about respondent’s aims and objectives. Interestingly, the vast majority of respondents stated that property is not their main source of income, with only 20% of respondents relying solely on property to fund their lifestyle. However, this is significantly more than the market as a whole, with the English Private Landlord Survey 2018 suggesting only 4% of landlords let property as a full-time business.

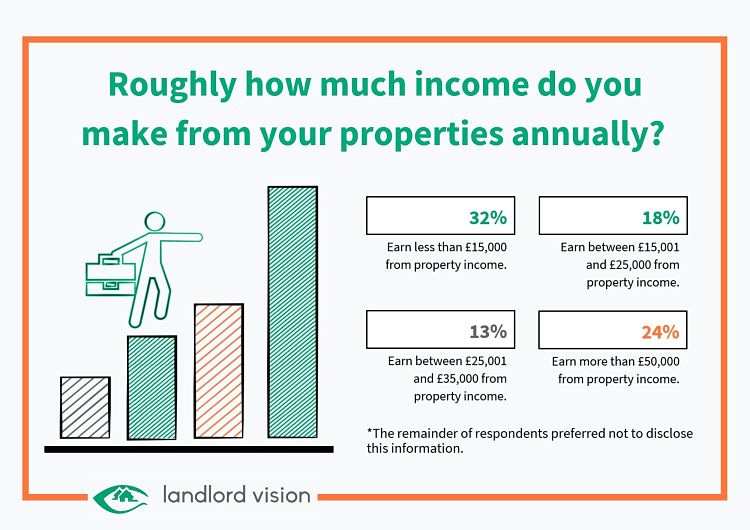

How Much Income do Landlords Make from Their Property Businesses?

As part of the survey, landlords were asked to disclose how much income they make from their properties each year. The responses show a significant variation in incomes. Nearly a third of landlords earn less than £15,000 per year from their property investments. Whereas 57% of respondents earn more than £15,000 from property income each year. Interestingly, nearly a quarter of respondents earn in excess of £50,000 per annum. This roughly correlates with the proportion of landlords that rely on their properties as a sole source of income, perhaps suggesting that many landlords feel that £50,000 is around the level where they feel comfortable relying on their portfolio to fully fund their lifestyles.

Where are the Most Popular Regions for Landlords to Invest?

The Landlord Vision Survey asked landlords to indicate the regions in the UK where they operated rental properties. Responses show a clear preference towards the South East (18%), London (18%), and the North West (13%). These regions account for a disproportionate number of investment properties, relative to the number of households. The North East also appears to be a relatively attractive location for landlords, with 5% of respondents indicating that they operated properties in the region. At the other end of the scale, Yorkshire, the West Midlands and the East of England appear to be less attractive locations for landlords. The same can be said of Scotland, with only 4% of respondents operating properties in a country that accounts for 9% of the UK’s total households.

| Region / Country | Proportion Of UK Households* | Location Of Respondent’s Properties |

| North East | 4% | 5% |

| North West | 11% | 13% |

| Yorkshire & The Humber | 8% | 6% |

| East Midlands | 7% | 7% |

| West Midlands | 9% | 7% |

| East | 9% | 7% |

| London | 12% | 18% |

| South East | 13% | 18% |

| South West | 9% | 9% |

| Wales | 5% | 4% |

| Scotland | 9% | 4% |

| Northern Ireland | 3% | 1% |

*ONS Data: Total number of households by region and country of the UK, 1996 to 2017

What Type of Let is the Most Popular Amongst Landlords?

Respondents were also asked to clarify which type of tenants they let to, with the vast majority indicating that they operate what may be deemed to be more ‘conventional’ residential buy-to-lets. Nearly three-quarters of landlords surveyed rent to professionals (43%) and families (29%). One in ten landlords rent to social or housing authority tenants, with a further 8% opting to rent to students. Only 5% of respondents indicated that they operate commercial property, with short-term lets such as AirBnB and holiday lets accounting for just 3% of respondents.

Interestingly, despite the vast majority of respondents focusing on traditional buy-to-let properties, 68% of landlords would consider diversifying their investments and buying non-residential lets in the future. Holiday lets appear to be one of the more popular non-conventional investment strategies, with 27% of respondents indicating that they have actively considered purchasing a holiday let or short-term let. Commercial properties, with their high yields and stickier tenants, prove to be similarly desirable, with 17% of landlords open to the idea of investing in such properties. Finally, and somewhat surprisingly, only 15% of landlords indicated that they would consider diversifying into Houses in Multiple Occupation (HMOs).

Professional Services for Landlords

With only 20% of landlords operating their properties as a sole source of income, it is unsurprising that the majority of investors rely on professional services to support and manage their portfolios. When surveyed, 53% of landlords said that they pay an accountant to manage their property finances, whilst 52% stated that they use letting agents.

Landlord Vision asked landlords to indicate how much they paid letting agents for their services each year. For the most part, the majority of landlords that use letting agents pay between £1,000 and £5,000 per annum, with the average figure being around £2,000. As a proportion of rental income, most landlords pay between 6% and 10%, with 10% being the most common percentage given.

Committed to the Private Rental Market

It is fair to say that the past decade has been a tumultuous one for landlords. Whilst prices have continued to grind higher most years, increasingly hostile legislation and the stress of managing properties has driven a significant proportion of landlords to sell up and leave the market. However, those landlords who have weathered the storm intend to persist with property investment long into the future.

Only 2% of the respondents to the Landlord Vision Survey intend to sell their properties and exit the market. In contrast, around half those surveyed plan to continue investing in property indefinitely, or at least until retirement. A further quarter of landlords (23%) suggest that they plan to hold onto their properties for at least another 10 years before selling.

If you’d like to see the full Landlord Vision Landlord Survey, get a copy of the results below:

Disclaimer: This ‘Landlord Vision’ blog post is produced for general guidance only, and professional advice should be sought before any decision is made. Nothing in this post should be construed as the giving of advice. Individual circumstances can vary and therefore no responsibility can be accepted by the contributors or the publisher, Landlord Vision Ltd, for any action taken, or any decision made to refrain from action, by any readers of this post. All rights reserved. No part of this post may be reproduced or transmitted in any form or by any means. To the fullest extent permitted by law, the contributors and Landlord Vision do not accept liability for any direct, indirect, special, consequential or other losses or damages of whatsoever kind arising from using this post.