When it comes to handling the taxes for your buy to let investment any loss in profit you make is handled in a specific way. In this post we’re sharing exactly how you should account for buy to let losses in the most tax efficient way.

Income Losses

Basically, all of the lettings you have in the UK are regarded as one business for the purposes of tax, so if you make a loss on one letting (perhaps because of a large repair bill), that loss can be set against your net rental income from your other properties as part of the same business. If you also have properties let overseas, then they are deemed to be in a separate business and your UK property losses cannot be set against overseas property profits (and vice versa).

If you have no other properties, or if there is still some loss left after setting it off against the income from them, then the remaining loss can be carried forward to the next tax year, and the next, and so on, for as long as you are a landlord, until it has been relieved against letting income.

Losses on lettings cannot normally be set against any other income of the year (such as your salary, profits from your trade or profession, or other investment income such as bank interest).

The only exception to this is where part of the loss includes Capital Allowances (or certain agricultural expenses) – that element can be set off against your other income for the year of the loss and the following year. Such claims are relatively rare for typical residential BTL businesses because Capital Allowances claims tend to be quite modest; commercial properties can result in much more substantial CAs claims, which can be quite useful. Another reason to eschew the cash basis for landlords is that even where losses are attributable to Capital Allowances, sideways loss relief against other income is prohibited under the cash basis.

Note that while you may pool all of your personally- and jointly-owned rental properties together, property profits and losses from acting in a partnership or as a Trustee should be pooled separately. Likewise, losses on properties that are not let on a commercial basis – say at a significant discount to a close friend or relative – are ring-fenced and may not be deducted against mainstream letting profits.

It is sometimes difficult to decide whether you are simply a joint or co-owner in a property letting business, or a partner in a property letting partnership, and we shall consider the main issues in the next section.

Capital Losses

If a property developer sells a property at a loss, then it is likely a loss arising to the trade of developing and selling property – an Income Tax loss. A property investor who sells a rental property at a loss will be subject to the CGT rules for capital losses.

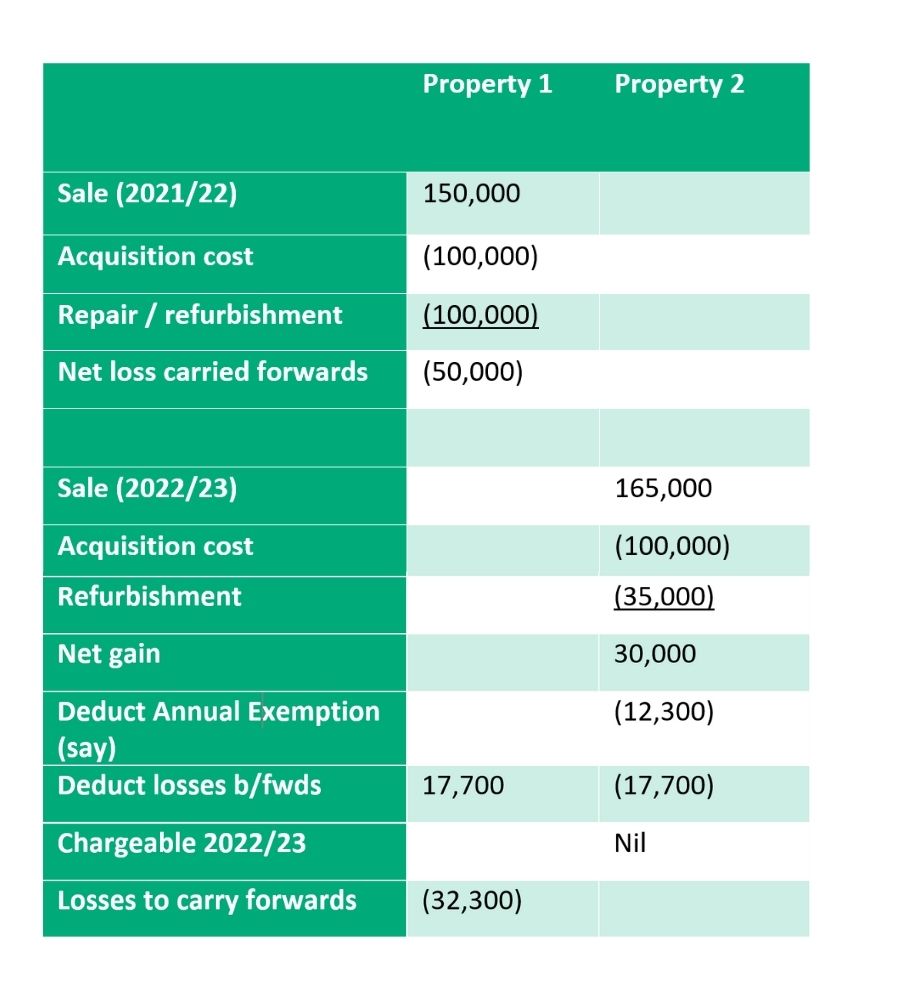

Capital losses are set against capital gains arising in the same year, which may mean that a loss made by an individual (or a non-corporate body) is used against a gain that would otherwise be covered by his or her CGT Annual Exemption. This may seem unfair, but if the taxpayer ends up with a net loss, it can be carried forwards indefinitely to set against the next capital gain and will be used only to reduce aggregate gains in that later year to the point where they can then be covered by the relevant Annual Exemption, so large capital losses carried forwards will not continually be frittered away against Annual Exemptions:

Example:

Indra acquires 3 similar terraced properties in 2020 for £300,000 as a “job lot” at auction, with the intention of doing them up and letting them out. Unfortunately, one of the properties has suffered substantial subsidence and costs spiral; he is ultimately forced to sell both the blighted property and one of the remaining two properties to recover some liquidity:

However, if Indra could stagger the disposal so that the loss on Property 1 arises in the tax year before the gain on Property 2:

By crystallising the capital loss separately in its own tax year, Indra has secured £12,300 extra to carry forwards. Whether it is ‘worth it’ will depend on how urgently Indra needs to recover cash liquidity, how volatile is the local housing market (there is not much point to holding out for better capital losses if the selling price of Property 2 falls by £15,000 in the interim!) and how likely it is that Indra will get to make substantial future capital gains, against which that enhanced capital loss might be set. Of course the properties might instead have been acquired through joint ownership with spouses, friends or family, in which case the overall enhancement of capital losses through staggering disposals could be significantly increased.

Lost Deposit on Off-Plan Purchases

HMRC has traditionally resisted claims for capital losses where an investor funds a deposit and/or stage payments for an off-plan development that goes wrong, broadly by arguing that the investor never actually acquired anything in the first place, then to lose. However, a recent tax case (Lloyd-Webber & Anor v HMRC [2019] UKFTT 717) held that these were not phantom losses, but could validly be claimed for CGT purposes: the assets might not have been tangible land or buildings but were nevertheless substantive contractual rights. This is arguably very good news for offplan investors who suffer a loss when a deal falls through, but note:

- This was a case heard at the First-Tier Tribunal and, although persuasive, does not set a binding precedent (although the appellate case on which this judgment was based certainly did).

- HMRC could appeal.

- The judgment seemed to imply that the Lloyd-Webbers were successful only because the developer had failed to complete the contract, and the outcome might have been different if they as investors had abandoned the contract instead.

If you think that this may apply, then you should seek advice: note that capital losses must be claimed under the Self Assessment process, and could be permanently forfeit if they are not included in a tax return.