If a tenant stops paying rent, it can put their landlord in a tricky situation.

There are many reasons why a tenant may stop paying rent, with some reasons being more valid than others. However, if a tenant experiences financial difficulties and is unable to make rent payments, it can create an upsetting and stressful situation for both the tenant and the landlord.

Managing a rental property is a business though, and many landlords would fall into financial difficulty themselves without the rental income from their property.

Dealing with tenants that have stopped paying their rent can be challenging, but there are laws in place to protect both the tenant and the landlord in these circumstances.

Landlords have rights when it comes to non-payment of rent, but they must understand and follow the correct legal procedures to ensure that they deal with the situation fairly and lawfully.

In this article, we will explain what rights landlords have when it comes to non-payment of rent and what steps they can take when a tenant stops paying their rent.

What Can Landlords do to Protect Themselves from Rent Arrears?

Although landlords cannot do anything to prevent non-payment of rent from happening, there are certain measures they can take to reduce the risk and prepare for such a situation.

Reference Tenants

Even the best-intentioned tenant may find themselves in a situation where they can no longer pay rent. However, a tenant that has run into problems previously, is more likely to do so again. Landlords can minimise the risk of non-payment by obtaining a reference from every potential tenant’s previous landlord confirming that they paid rent on time. It is also wise to perform a credit check and request copies of bank statements for the last three months to confirm that they have received a regular income.

Form a Good Relationship With Tenants

Forming a good relationship with your tenants and maintaining regular communication can encourage tenants to be upfront with you sooner rather than later if they are going to have a problem with paying rent. You can then work together to address the situation proactively.

Make Sure Your Insurance Policy Covers Rent Arrears

Landlords can add a special type of insurance called rent guarantee insurance (or tenant default insurance) to their landlord policy to provide them with financial protection if their tenant stops paying rent.

Keep Good Records

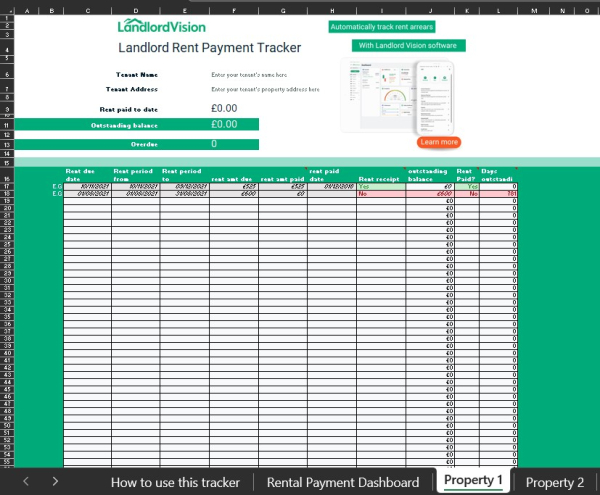

There is a lot to be said about being organised, especially if you’re a landlord managing multiple properties. Having a system in place to track rent payments can help you to spot potential problems with rent arrears as soon as they crop up. Taking a proactive approach to rent non-payment can help to prevent the situation from escalating further.

And if things still do go wrong? Landlords have legal rights and procedures to follow to protect their financial interests and resolve the problem in the event of non-payment of rent.

What Legal Rights and Protections do Landlords Have When a Tenant Stops Paying Rent?

Landlords are protected by the law, just like tenants.

If a tenant breaches the terms of their tenancy agreement and stops paying their rent, then this could have serious financial repercussions for the landlord.

Key UK laws that are in place to help protect landlord rights when it comes to non-payment of rent include:

- The Housing Act 1988 – Provides landlords with the right to terminate a tenancy if the tenant has breached the terms of the agreement.

- The Protection from Eviction Act 1977 – Provides landlords with the right to evict tenants using the correct legal process.

- Landlord and Tenant Act 1985 – Provides landlords with the right to recover unpaid rent from tenants either through the courts or by deducting it from their tenancy deposit.

Having a good understanding of what your rights are as a landlord can help you to protect your investment, avoid legal disputes, and take swift action to find a resolution and minimise financial loss when faced with a tenant who has fallen into arrears with their rent.

What to do When a Tenant Misses a Rent Payment

Ok, so you know your rights, but would you know what to do next if your tenant stopped paying rent?

Act Immediately

There is no time like the present, so if you notice that a tenant is late paying rent it’s wise to act immediately rather than waiting to see what happens next.

Communicate With the Tenant

Your first port of call when a tenant is late paying rent should be to pick up the phone and call them. Have a chat and find out whether it is a short or long-term problem that has caused your tenant to miss the payment. If they are stressed, upset, or agitated about the situation, always make sure you stay calm and professional. If the tenant does not pick up the phone, try leaving them a message and reaching out by email or text message instead. If you cannot get in contact with them, a formal letter should be sent requesting the outstanding payments and outlining what will happen if they do not pay. Be sure to keep records of all correspondence between you and the tenant in case you need them as evidence later down the line.

Look For a Solution

If you manage to have a good, open conversation with your tenant about why they’re late with their rent, then afterwards you should have a better idea of where you both stand. You should discuss with the tenant possible ways to resolve the issue, depending on what the situation is, this could involve one or more of the following solutions:

- Agree to a date by which the rent will be paid.

- Agree to a repayment plan.

- Tenant explores other sources of financial help, eg. housing benefits.

- Allow the tenant to break their contract and move out.

Speak to the Guarantor

If your tenant has provided a guarantor, you can contact the guarantor 14 days after the missed payment to request that they settle the outstanding debt.

Speak to Your Insurer

If your insurance policy includes tenant default insurance, you should be able to claim for missed payments and tenant arrears. Speak with your insurance provider to find out whether you can claim and how to do so.

After 14 Days, Send a Letter

If you are unable to get in contact with your tenant, or they have still not paid 14 days after the rent was due, a formal letter should be sent (preferably hand delivered) informing the tenant that if they do not pay you will seek possession of the property. If the tenant has a guarantor, a letter should also be sent to them.

After 21 Days, Send Another Letter

If the tenant has still not paid after 21 days, a final letter should be sent requesting the amount owed and informing the tenant of your intention to take legal action if it is not paid.

Serve a Notice of Eviction

Once the next month’s rent is due, the tenant is considered to be two months in arrears. If you have followed all the previous steps to try to resolve the issue to no avail, then you have a right to claim possession of the property and evict the tenant. No landlord wants to be put in a situation whereby they must evict a tenant, and tenants should only be evicted as a last resort. Managing a buy-to-let is a business though and you can’t afford to have tenants living in the property for free.

How Can a Landlord Legally Evict a Tenant For Not Paying Rent?

Landlords can evict tenants for not paying rent, but only under certain circumstances and following a certain legal procedure.

Landlords found to have evicted a tenant unlawfully could face legal action, compensation claims, or even criminal charges, so proceed with caution and ensure that you are carrying out the process by the book.

There are currently two different routes for evicting a tenant who has stopped paying rent. Landlords can either serve the tenant a Section 8 notice or a Section 21 notice. Although the government have proposed the abolishment of the Section 21 notice very soon, more on that a bit later.

Section 8 Notice

A Section 8 notice can only be served if a tenant has broken the terms of their tenancy agreement (one way in which they may do this, is by missing rent payments or paying rent late.)

Section 21 Notice

A Section 21 notice is perhaps a little more controversial. It is also known as a ‘no fault’ notice, as the landlord is not required to give a reason for issuing it. Section 21 notices are usually used when a landlord wants the property back at the end of the tenancy agreement and the tenant does not want to leave. It can sometimes be quicker to use a Section 21 notice if the tenant was already nearing the end of their tenancy when they stopped paying rent. A Section 21 notice can only be used when the tenant has been in the property for at least four months.

Government Plans to Abolish Section 21 Evictions

Whilst landlords can still use Section 21 notices now, they are probably not going to be around for much longer.

In April 2019, the government announced that Section 21 ‘no fault’ evictions were to be abolished, but so far, no further action has been taken.

The plans to scrap Section 21 evictions have been made in a bid to give tenants a fairer and more secure deal and to protect them from short-notice evictions.

The Queen’s Speech in 2022 confirmed that a Renters Reform Bill would be introduced in the 2022-2023 parliamentary session, so there’s a good chance that Section 21 evictions could be abolished later this year.

Going to Court Over Rent Arrears

If your tenant does not leave the property or pay you the rent that they owe, then you can go to court to resolve the issue.

To be successful in court, you will need to have followed the correct legal procedure up to this point and have evidence of this.

If a tenant has refused to leave the property at the end of the Section 8 notice period, then you can apply to the court for a possession order.

A possession order may also instruct the tenant to pay the landlord any rent arrears, court fees, and legal costs.

If the tenant still does not vacate the property after the date set out in the possession order, then the landlord can request a warrant for possession from the court. If the tenant does not leave by the date set out in the warrant of possession, then bailiffs will evict them.

Non-payment of rent can be a real headache for landlords, particularly if they rely on their rental income to pay their monthly mortgage. As a landlord, the most important things you can do to stand yourself in good stead if your tenant stops paying rent is be organised, communicate with tenants regularly, and know your rights.