Price caps on energy have been announced, there is a whole new wave of concern about the cost of living increases.

Students are facing increasing costs of loans.

It is important that every landlord takes note of escalating costs of utilities because any huge cost of living rise has the potential to put rent payments at risk but those who offer “all inclusive” rents more so.

I want to begin by looking at the facts

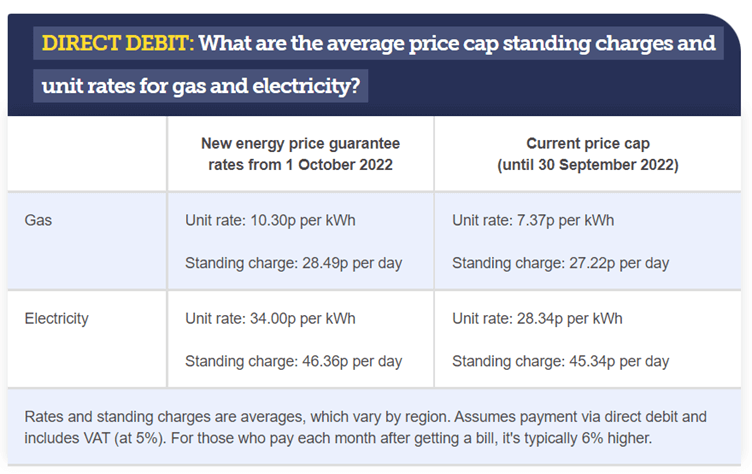

The cap from October:

“The energy price cap is misnamed – there’s no cap on how much you pay. The cap is actually on the standing charges and the unit rates for gas and electricity, and this means if you use more energy, you’ll pay more. Yet the cap is usually quoted as an annual figure, based on a typical amount of energy use (currently £1,971 a year, but it’s set to rise to £3,549 a year on 1 October 2022).”

What are the price cap unit rates? (moneysavingexpert.com)

There is a calculator to enable a calculation based on either your annual usage or your current monthly spend on that page.

From this we can estimate the increase in our bills if we do nothing to reduce consumption but what about those of us who want/need to reduce consumption, including the many landlords who offer HMO rooms at an all-inclusive rent? These landlords may want to help their tenants to limit their energy consumption so rents don’t need to be raised. We need to begin by looking at which items consume most power.

Costs of Gas for Landlords

I am not going to talk too much about the cost of gas because the big cost is from central heating and I covered this in depth, including why controlling central heating is neither cost effective nor likely to keep your rooms let, in my article in March 2021 here:

And again in March this year here:

I will just add some additional information that I found recently

“A recent report by the Heating and Hot Water Council (HHIC)* found that households can save around 6-8% in gas just by turning down the heating flow temperature on their condensing combi boiler. To be clear, this is not turning down your thermostat”.

If you have a condensing/combi boiler and want to reduce the running cost without compromising on heat the full details are here

Lower the flow temperature on your boiler to save ££ (theheatinghub.co.uk)

Electricity Costs for Landlords

I am grateful to a Facebook friend for sharing this information:

Cost of running individual items with the new electricity cap of 52p kw (From 1st October 2022)

- 1kWh fan heater / electric radiator = 52p/hour

- 2 kWh fan heater / electric heater = £1.04/hour

- 3 kWh immersion heater = £1.56/hour

- 5w LED light bulb = 0.26p/hour

- 40w electric blanket = 2p/hour

- 60w light bulb – 3.12p/hour

- 8KG Washing machine (A rating) = 26p/cycle

- 8KG Washing machine (D rating) = 55p/cycle

- ‘Tumble Dryer – Heat Pump – A rating = £1.13/cycle

- ‘Tumble Dryer – Condenser – C rating = £2.33/cycle

- Oven = 52p/hour

- Electric hob halogen per ring = 85p/hour

- Electric hob induction per ring = £1/hour (surprising?)

- Microwave 900w = 47p/hour

- 200w slow cooker = 10p/hour

- 42″ TV = 6p/hour

- Computer monitor = 1p/hour

- Xbox One S = 6p/hour

- PS4 = 7p/hour

- ‘Amazon echo dot = 0.2p/hour

- Sonos One = 0.7p/hour

- Google Nest mini speaker = 0.2p/hour

- Laptop = 2.5p/hour

- American style Fridge Freezer = 2.5p/hour 60p/day

- Freestanding fridge freezer = 1.45p/hour 35p/day

- Under counter fridge = 0.6p/hour 16p/day

- 75 kWh electric shower = 6.5p/min

- 9 kWh electric shower = 7.8p/min

- 10.8 kWh shower = 9.3p/min

- Electric kettle = 2p/min

- Electric showers are big consumers but when they are used reasonably for short bursts, they do not make a major contribution to the overall bill and this is one of the changes I made to my all electric properties. I removed baths, there were already electric showers. What reduced the bills dramatically was removing the emersion heater which is a power guzzler, and they are often left on for hours to keep a tank of water hot but even where the tank has a really good coat of insulation it will continue to cool down and heat up all day. I fitted an in-line water heater to heat water for basins and sinks instantly only costing what is consumed each time to heat. Some of my tenants took some convincing, they are paying their own bills and didn’t see a problem but in the end, they agreed and they have since reported big reductions in their bills which I am sure they will be glad of this winter.

Landlords who are paying the bills need to consider these changes and even where the tenant is paying its important to help to keep their bills down to avoid potential rent arrears.

When charging “all inclusive” it’s down to the tenant to control the consumption so it’s time to have a chat with tenants where we explain that increases in utility bills have to be passed on in rent increases. However, tenants can avoid this if they take measures to decrease their energy consumption.

- Do not linger in the shower – each 10-minute shower averages 80p. if each of 5 tenants take just one shower a day the cost is £120 a month and that’s before the cost of a hair dryer and washing and drying the towel is added.

- Do not use fan heaters – at an average cost of 76p.an hour if each of 5 tenants used a fan heater for 2 hours a day/night the cost would be £228 a month that’s in addition to the cost of gas for central heating.

- Do not charge electric cars at the rental property – this is common and it’s only going to get more popular in time.

- Do not allow friends and family to cook nor do laundry in the property.

Things Not to Expect From Tenants:

- Using a washing line to hang out their washing – yes, its very eco-friendly and cost effective but in the winter months it’s not as feasible due to cold and wet weather.

- To pay for a dryer via a coin meter. It’s less common for people to have cash and coins nowadays, so tenants are more likely to dry their clothes on radiators. This causes damp and mould which is an expensive problem to deal with. The best option would be to provide an energy efficient dryer, preferably A rated as this will cost half that of a C rated one as you will see above.

- Turing the light off each time they leave their room – at 26p an hour it’s not an expense that is going to drive up the energy bill when lights are left on temporarily. However you could still remind them of this expense. In addition make sure that all your bulbs are LED 5W and pay 26p an hour rather than 60kw bulbs at a cost of a shocking £3.12 an hour!

- That they will turn their room radiator down or off when they go away from few days/weeks, this is in any event not efficient as I explained in my article in March 2021, (linked above) why this isn’t a good idea and may cost you a lot more in the long run.

Things That we Can Expect From Tenants:

- Tenants may want to use microwaves more often in a bid to save energy, so it may be pertinent to include these in your properties.

- People tend to leave their laptops, computers, Xbox, PlayStation etc., on even when they are out but at a cost of just pennies it’s just not worth worrying about.

- Limiting the heating to be on at certain times of day may not be suitable for students or those who work anti-social hours. If the heating is turned off when they need it they may resort to fan and other types of electric heaters and these are more expensive to run.

- Those who work from home will be using laptops and computers, possibly the cooker and kettle more often than those who don’t, and this may be something you need to consider when pricing a rental

- Some may well charge their electric cars if the electricity is included in the rent and there is not a Fair Usage Clause – in my opinion this is now the number one risk factor for landlords who need to control their overheads. A Fair Usage Clause means that if they do this their house mates will be charged along with them. A Fair Usage Clause must include the fact that if the estimated spend is less than you have allowed you will share the difference among the tenants.

“The cost of charging an Electric Car is going to increase significantly from October. A city car, taking an average mileage of 8,100, will cost £551.66 more at £1,192.85 while a large SUV will increase by £741.22 to £1,605.98. This now represents the biggest threat to landlords who are charging “all inclusive” rents more than bitcoin mining and cannabis farming.”

Source of costs above which.co.uk

Returning to the student market, the fact that more and more students remain in their term time addresses for most of the year has a significant impact on the energy bills, they are paying full rent they are entitled to live there, but this needs to be taken into account when costing student rentals. We also need to be aware of the increase students are facing in the cost of their loans announced at the start of the year:

“The Government has announced sweeping changes to the student loan system in England that will drastically increase the cost of education for those attending university, including lowering the repayment threshold to £25,000 a year and increasing the length of time over which graduates repay their loans by 10 years”

This has the potential to cause two issues

- Students trying to manage on less

- Graduates having less disposable income when they start their working life and need to rent

Going back to energy cost increases; I asked on several Facebook groups for information about how landlords calculate the cost of utilities to arrive at rent increases to ensure that they are not making a loss – a very real possibility at the moment.

I asked:

LANDLORDS OR AGENTS OF HMO

I’m working on an article about energy costs in bills inclusive HMO and the following information would be very helpful

5/6 bed

1. What amount do you allow for

A. Gas.

B. Electricity

2. how did you calculate the amount?

A. Units used in the past

B. Costs in the past

C. Something else – please say what

3 How do you plan to cover cost increase?

4. What are your main concerns about increasing energy costs?

I received various replies not all giving me the information that I hoped for but some giving me extra information which is useful and which I will now share to help if you are one of the many landlords who replied that they would basically take a guess!

These may be useful:

1) G 25000 kw/h. E 7000 kw/h

2) £10 pp/wk cap although this was done Oct 2021.

3) absorb some-more inspections myself-endless times found immersion on and boiler working despite signage.

4) can only pass on so much

I used to allow 1500 for each of my houses for Gas/Elec which covered it up until coming off fixed term deals

Usage is almost identical (especially gas) from a 5-bed to 8-bed HMO.

My contract on a well insulated nine bed HMO (five bed main house and four bed annex) did allow for up to £30pppcm for gas and electric I’ve now put that up to £45 pppcm. I came to that figure based on previous bills, but I can charge them more if they go over. In previous years for the five bed part of the house uses around £110 to £210 pcm for the gas and electric depending on the time of year. This month’s bill despite being summer is around £220. It’s looking like this coming year it will go over the allowance so I intend to educate the tenants and show them how to set the timer so the heating isn’t on all night. I’ll probably end up paying any over usage myself but next contract I’ll up the rents and allow £60pppcm

…most of mine pay their own gas and electric on key and card but the nine bed has only one electric supply to both house and annex but two gas supplies so I pay it and charge what I think they will use. I find that most tenants haven’t a clue what energy things use in the house. All well and good switching off a nine watt light bulb off for half hour while you’re not in a room but if you’re going to spend 25 minutes in the bathroom with a 9500watt shower on the go then that’s what’s costing you dearly.

Since 2021 we budgeted for 6k pa per house to cover all bills Inc Internet (but not council tax) . That’s not going to be exceeded. It costs at least 12k pa to run an HMO before the mortgage. Tenants don’t want restrictions and without careful knowledge restricting their freedom to adjust the settings will be a breach of legislation and likely HMO pscs and result in empty rooms.

We tried to educate our tenants but found they just ignored us! Several times explaining that using the tumble dryer in July when it’s 31degrees outside and the lights and tv’s left on will cause bills to rise however still ignored. So, it’s simple for us price rise is x divided into number of rooms divided into number of weeks equals rent increase.

1. £180 total for a five bed – split vary depending on consumption (summer 70/90 ; winter 90/90)

2. Prior years costs (£100/month + 90% increase

3. I will not cover. Tenants must cover. Rent includes energy bills up to £180. Thereafter tenants responsibility.

4. Rents for next year tenants – would probably exclude bills entirely and lower the rent by £200/month.

I think this energy crisis is the greatest challenge ever for the HMO industry. We have over 200 HMO tenancies in about 40 properties. I have taken the month with the highest consumption from last winter for each property. Then for each property, I multiplied by the cap increases (increase = the last year’s worst month x 1.8 x 1.8 x 1.4 – the last year’s worst month), figured out the expected increase, and finally divided by the number of rooms in the property.

I got various figures for different properties of course but the overall average worked out as a staggering £190 INCREASE PER ROOM / PER MONTH.

I’m contemplating solar panels on this house as it’s got enough south facing rooves for 4kw ….D into a C rating for epc . Our houses are on commercial contracts (no price cap available). One 10 person HMO was recently due to come out of contract (electricity) and EDF gave an estimate of the new annual amount based on the previous usage from £6,000 to £20,000.

Property 1 – 125 year old mid-terrace, in the town centre, let to students Gas heating and water inc showers. Last 12 months 18258 kwh of Gas and 7436kwh of Electricity. Based on November 2020 price, that was £1733 a year, based on the price cap from October 2022 it will be £6740 a year

Property 2 – 50 year old 3 story link house let to professionals, Gas heating and water inc showers. Last 12 months 17515 kwh of Gas and 5408kwh of Electricity. Based on November 2020 price, that was £1409 a year, based on the price cap from October 2022 it will be £5600 a year.

Just like to point out one of my concerns from an Energy broker point of view for all Landlords. Please try and get ACTUAL Annual meter readings to work out your calculations. Do not go by supplier past usages as they more often estimated. Even though many state your Annual usage and then is small print underneath they state these are estimated. They can be far out as I have worked out for many clients. It’s a good exercise to carry out on a spreadsheet. Try and get reads for winter periods and summer periods. With energy prices the way they are you do not want to have underestimated. I have had clients who’s smart meters stopped working and the suppliers have hit them with bills with 3 yrs of usage

I have worked out my consumption I will be increasing rents per room of between £60 and £120. This is without factoring in Jan / April 23 price hikes.

Energy costs used to be 5% of our running costs. Based on estimated planned energy cap raises the cost will be about 25% of costs at April 2023. We have a target rent increase of about £100 per month per room.

My Advice:

Get out last year’s bills and calculate the usage then calculate the future costs given the increase due in October. Make sure that you don’t end up subsidising the fuel costs to the point where there is no longer a profit to be made. If you have already increased your rents or signed new contracts it will be a year before you can increase them again and it’s even more important to have a Fair Usage clause and enforce it.

On a lighter note on one of the local community groups a member is offering to sell electricity to people to charge their cars overnight at £35 because he has surplus electricity from his solar panels.