Manchester is the largest city in the northwest. It is the birthplace of feminist icon Emmeline Pankhurst, vegetarianism, and Coronation Street. It’s also the home of two Premier League football teams, an international airport, and a cool music scene. Not surprisingly, this makes Manchester a great place to live, which is why it’s currently the number one investment city for landlords.

Aldermore Tracker

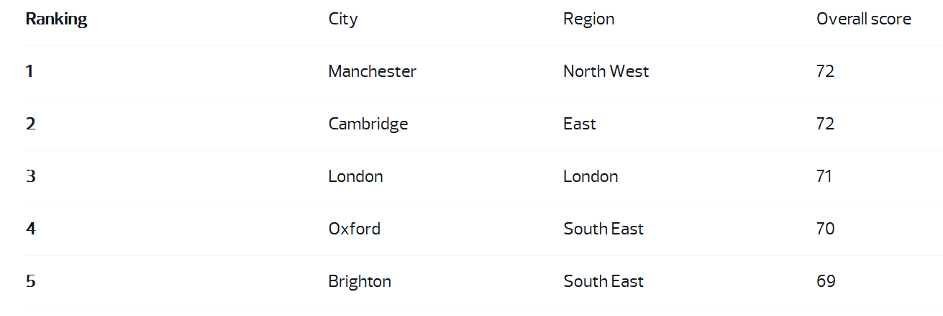

Research carried out by buy to let lender, Aldermore, has revealed Manchester is now in the number one position as the most desirable place for landlords to invest in property, knocking Oxford off the top spot. Next on the list is Cambridge, followed by – surprisingly – London, Oxford, and Brighton.

“Aldermore’s Buy to Let City Tracker shows that across the UK there are still great short and long-term returns to be had for landlords, with a number of cities providing excellent rental yields with room for capital growth,” says Jon Cooper from Aldermore.

“The private rented sector is vital to the economy right now and its recovery from the pandemic so landlords should seek portfolio advice from their lenders to see how they can look at new ways to support the sector.”

Top 5 Cities for buy to let Investment

Aldermore tracked various desirability indicators, including house price growth, average rent, rental yields, and the size of the local rental market. Manchester scored 72, with Milton Keynes at 64 on the #10 position.

What Makes Manchester so Desirable?

Part of Manchester’s appeal as a great investment city is that house prices are not ridiculous. The average price for a property in Manchester is £202k, which isn’t the lowest but is still more affordable than cities like Reading and Brighton.

Low vacancy rates are also a factor, with 31% of the population living in rental accommodation. Manchester has two large universities, which provide a steady stream of student tenants.

There has also been significant investment in the city in recent years, which has encouraged economic growth and boosted the jobs market. Although the city has suffered stricter lockdowns than other areas, there is hope it will bounce back next year.

All of these factors make Manchester a profitable place to invest for landlords seeking a good return on their properties. Despite the attractions of Manchester, cities in the South are still popular choices for landlords seeking a long-term investment opportunity.

It costs significantly more to buy a property in Brighton and Oxford (£428k and £524 respectively), but capital gains and rents are higher. London scores well despite low rental yields due to the hike in property prices over the last 10 years.

Wales isn’t so attractive to landlords. Average rental yields in cities like Newport and Swansea are relatively low, and house price growth is also low. Cardiff offers decent returns in the short-term rental market.

Do Your Research

Whilst headline-grabbing lists like this are useful, it’s important to do your own research before investing in rental properties. Often, buying locally makes more sense if you plan to manage your own portfolio. If you do decide to invest in a different area, speak to local letting agents and weigh up the various costs.

Are you a Manchester landlord? Is your portfolio generating decent returns? Get in touch on Twitter or Facebook and let us know.