Running rental properties in the UK isn’t easy money. In fact, running rental properties in the majority of places across the world is no small feat, particularly with the way the market has been positioned for the past few years.

But while property investing can mean navigating some tricky financial waters, it’s not a matter of sinking or swimming, it’s about being aware of how you can best manage the task and equipping yourself to do just that.

By having accounting skills, as well as connections to people who specialise in this area, you’re going to be far more likely to get the most out of your investments as a landlord and be able to reap the full benefits of what can be a great business decision.

In this article, we’ll explore how having accounting skills can boost your property game in every sense of the activity – from knowing how to handle mortgages and taxes to budgeting for repairs and vacancies, and everything in between.

We’ll also provide some tips on how to gain accounting knowledge, soak up the experience of others, and maximise your success through additional resources.

Why Accounting Skills Are Important in Property Investment

Many landlords feel swamped trying to learn all the accounting skills needed to track income and expenses, follow tax laws, and make profitable choices.

Without grasping some key money principles, it’s easy to make costly slip-ups like missing tax breaks, running short on cash, or seeing investments underperform.

Nowadays, landlords face more administrative and regulatory burdens than ever. Keeping up with constantly changing tax codes, safety regulations, and reporting requirements takes major financial savviness.

On top of that, making financial mistakes due to accounting illiteracy can lead to HM Revenue and Customs (HMRC) fines and audits – which is something you’re definitely going to want to avoid, and for obvious reasons.

Of course, then there are rising interest rates that have the potential to add further challenges – as the Bank of England boosts rates to combat inflation, landlords’ mortgage payments are increasing significantly.

Unfortunately, those on variable-rate mortgages can feel the pinch immediately. Meanwhile, limited company landlords face larger tax bills as they lose the ability to offset loan interest against rents for tax purposes.

Dealing with these headwinds requires financial know-how, but the good news is, there are ways to learn it. Managing the financial responsibilities of property investments is no doubt hard work, but the reality is that it’s a must-have skill for success.

By having the accounting basics down pat, you reduce the risk of falling into a situation you don’t want to find yourself in, and as a result, can really harness the power of smart property investment to see the rewards it can undeniably offer.

How Accounting Smarts Can Boost Your Property Game

There’s no doubt about it, learning money basics gives landlords power over their finances and helps avoid costly missteps. Let’s take a look at some of the key ways getting a handle on the ins and outs of accounting can level up your property management.

A+ Record Keeping

First things first, meticulous record-keeping is essential for property accounting. As a landlord, tracking all income and expenses for each property you own and keeping supporting documents like receipts and invoices will always come in handy.

When you have those basic accounting skills, it really helps when creating organised systems to log transactions, as they happen, and maintaining what can seem like an ongoing trail of paperwork.

By keeping your records tidy, it allows for accurate tax filings and easy financial statement generation when needed.

Cash Flow Planning

Like many situations, being prepared is a crucial skill to have up your sleeve. Not only does it help when it comes to financial forecasting, but it also helps with budgeting and the managing of cash flow.

Accounting knowledge will equip you with the tools to stay ahead of the game, so when costs like mortgages, maintenance, vacancies, and taxes come up, you already have reserves available and there’s no chance of any nasty surprises.

Tax Smarts

Tax – it’s necessary, but it can definitely sneak up on you if you aren’t staying on top of it. Having accounting knowledge means you’ll have a good grasp on what’s involved with setting aside and paying tax on your income generated from property ownership.

Understanding what your tax obligations are in terms of stamp duty and capital gains also works to maximise available deductions and relief to ultimately minimise tax bills.

Smart Decision Making

Nobody wants to go into any financial situation blind. Which is why accounting experience is so important when it comes to making informed investment decisions. Ultimately, you need accounting skills to gain access to data that will guide you toward profitable moves.

Preparing financial statements and analysing metrics like return on investment (ROI) also helps identify underperforming assets, assess renovation costs, and determine ideal pricing.

Tech Advantages

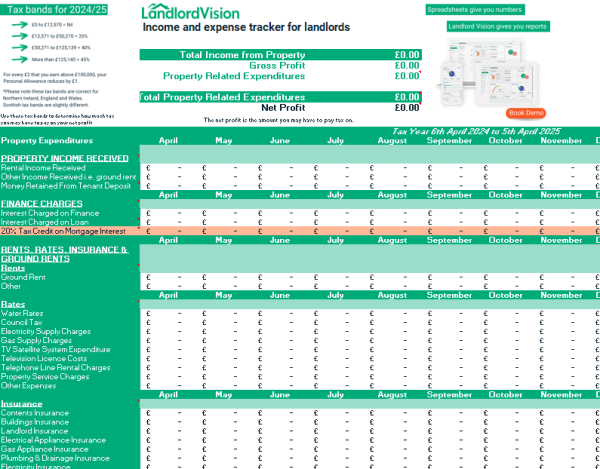

With the digital age ever-expanding our access to technical support, there are a whole host of accounting programmes and software that offer tools to simplify property management.

From being able to manage debits and credits to financial statements and accounting procedures, technology, when used properly, acts as a leg up for landlords and allows them to fully leverage real estate platforms.

Risk Reduction

Having strong accounting abilities also helps landlords to spot and prepare for risks, project possible costs, and highlight any vulnerabilities that might otherwise slip under the radar.

Actions like creating emergency funds, getting adequate insurance and planning for surprises help reduce risks that could hurt the bottom line.

Portfolio Optimization

In-depth accounting expertise also supports landlords to continuously fine-tune their financial practices. Being able to analyse past data can be incredibly beneficial in terms of guiding experiments with rental rates, new services, and cost-cutting to maximise returns.

Level Up Your Landlord Financial Game

Now that you know why having an accounting background is so vital to your success as a landlord, we’re going to give you some tips for growing your accounting literacy so you can upskill for long-term, sustainable wins.

Learn Accounting Basics

Especially with the increase in access to information, there are a myriad of resources for property investors wanting to level up through gaining accounting skills.

From books to online courses, these gems of knowledge allow landlords to pick up core accounting concepts including debits and credits, balance sheets, key terms, as well as profit and loss statements – all of which enable better money oversight.

Get an Accounting Tutor

If self-study doesn’t stick, an accounting tutor can provide personalised help to demystify property accounting for you. This way, they can explain how money principles apply directly to your rentals and teach you in a way that best suits your learning style.

Use Accounting Templates and Tools

As discussed earlier in the piece, technology, such as specialised spreadsheets, software, and tools, all simplify tracking and analysing your rental finances. Plus, user-friendly templates remove the accounting complexity of managing accounts and taxes.

Outsource Where Beneficial

If it all gets a bit too much, it’s definitely worthwhile considering outsourcing accounting tasks like tax prep and financial statements to pros.

Not only does their expertise save time and reduce compliance risk, but they can also really help you with maintaining records and keeping on top of it all.

Network With Fellow Landlords

If in doubt, hear someone else out. Connecting with other landlords is a great chance to learn from their financial practices and tools, so you can adapt and apply money management tips and insights to your own processes.

Automate When Possible

If there’s a better way of doing things, we should always be open to it. Have a look into automating repetitive tasks like collecting rent and tracking expenses. By doing so, it has the power to boost accuracy and free up time for more important landlord activities.

Keep Learning

In many facets of life, we are always learning. And when it comes to property investment, this is no different by any means. Continuously expanding your accounting knowledge through landlord workshops, courses, and qualifications is a great way to keep up to date with market trends and have your finger always on the pulse.

As regulations and best practices change, ongoing education prevents falling behind – there’s always something to learn!

The Bottom Line

We know that mastering financial fundamentals empowers landlords to take control of property finances, maximise tax efficiency, avoid costly blunders, and make smart investing moves.

With all the information you’ve now gained, we hope you can see that this is one of the best ways to approach property investment, and have learned at least one thing you can take away with you to work on.

And while hands-on experience is invaluable, combining it with accounting learning pays off big time for property owners. After all, understanding the numbers enables profits, and equally as importantly, peace of mind from your portfolio.

The bottom line is, making boosting your money skills an ongoing priority, alongside managing your properties themselves, is the only way to set your career in the industry up for lasting success.